Implementation of Minimum Hourly Wage & Increase in Legal Minimum Hourly Wage

All employees aged 21 and above are entitled to the legal minimum wage. This is the minimum amount the employee must receive for the work performed. For employees under 21, the minimum youth wage applies. Until the year 2023, the minimum wage was determined per month, week, and day. Because the monthly minimum wage is the same for all employees, the minimum wage per hour varies depending on the standard workweek.

From January 1, 2024, the legal minimum wage will change to a legal minimum hourly wage. This means that regardless of the number of hours in the workweek, the legal minimum hourly wage remains the same. The legal minimum hourly wage is set based on a 36-hour workweek and amounts to €13.27.

Example

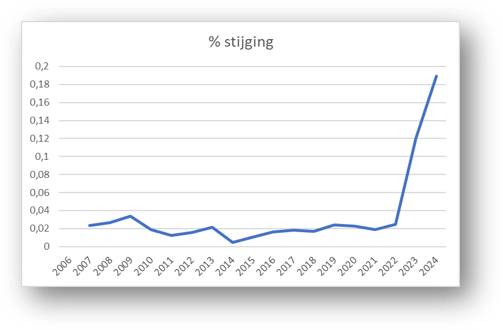

If your organization follows a 40-hour workweek, the minimum wage since July 1, 2023, was €11.51. From January 1, 2024, it must be at least €13.27, representing a 15.3% increase. The legal minimum wage also applies to certain income linked to the gross hourly wage, such as compensation for overtime and additional hours, as well as allowances (shift work, irregular working hours, etc.).

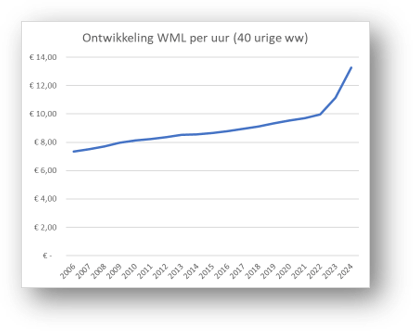

Percentage Development of Minimum Wage (WML) from January 1, 2006, to 2024 – Visual

As an employer, you are obligated to pay at least the legal minimum hourly wage. Failure to do so may result in a fine imposed by the Dutch Labor Inspectorate, and overdue wages must still be paid.

Learn more about the legal minimum hourly wage and rights and obligations?

Read more

Amendment to Hourly Wage Criterion for Low-Income Benefit (LIV)

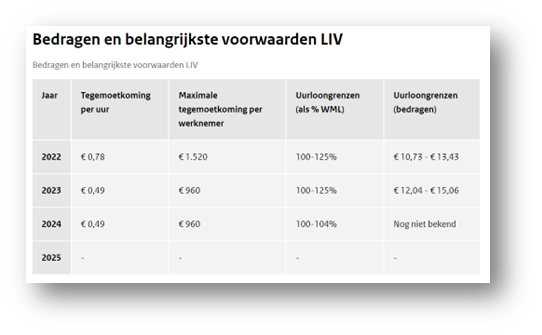

Starting January 1, 2024, the rules for receiving the low-income benefit (LIV) will be tightened. The LIV is a subsidy to employers who have employees meeting the criteria of a ‘low wage.’ For the year 2024, this means that the employer will receive LIV for employees who, on average throughout the year, have not earned more than 104% of the statutory minimum wage (WML). A second criterion that must be met is that the employee must work a minimum of 1248 hours for the employer in the year 2024.

If the employee meets both criteria, the employer receives €0.49 of LIV per worked hour, with a maximum of €960 per year.

The LIV has been in existence since 2017 and will cease to exist after 2024. Over the past years, the criteria have been tightened several times. The combination of the new statutory minimum hourly wage as of January 1, 2023, and the upper limit of 104% of the WML means that a much smaller group of employees will qualify for LIV.

For comparison

In 2024, the lower limit for eligibility for the low-income benefit is €13.27 (the statutory minimum hourly wage as of January 1, 2024). The upper limit (104%) is €13.80. In 2023, these limits were €12.04 (lower limit) and €15.06 (upper limit), resulting in many more employees falling within the eligibility criteria.

If you have employees for whom you receive LIV this year, there is a chance that this will no longer be the case in 2024 due to these changes.

Amounts and Key Conditions for LIV 2022 – 2025. Hourly Wage Limits for 2024 Now Known.

Source: Tax Authorities